Over the last year, we’ve seen huge revenge travel peaks, during which time metasearch - rich in high intent guests who are looking for hotels on specific dates - has seen huge growth as a channel continuing to be a golden opportunity for hotels.

And don’t OTAs know it.

It’s no secret that the volume of OTAs participating in the auction has skyrocketed, making impression share more and more difficult to obtain, not to mention the battle of cost-per-click amongst competitors driving costs up even further.

The good news is that hoteliers have access to more valuable data than ever before, which means fighting back on meta is possible. But capturing the right data is only one part of the solution. Hotels need to understand and apply that data correctly if they're going take booking share back from the OTAs.

Undercutting - the troublesome topic that’s never too far from a hoteliers mind - is not just stressful in terms of monetary impact on your business. It can also leave you swimming in a sea of data with no idea where to start your analysis.

The best place to start when digging into undercutting data is to ask a series of questions.

So let's begin...

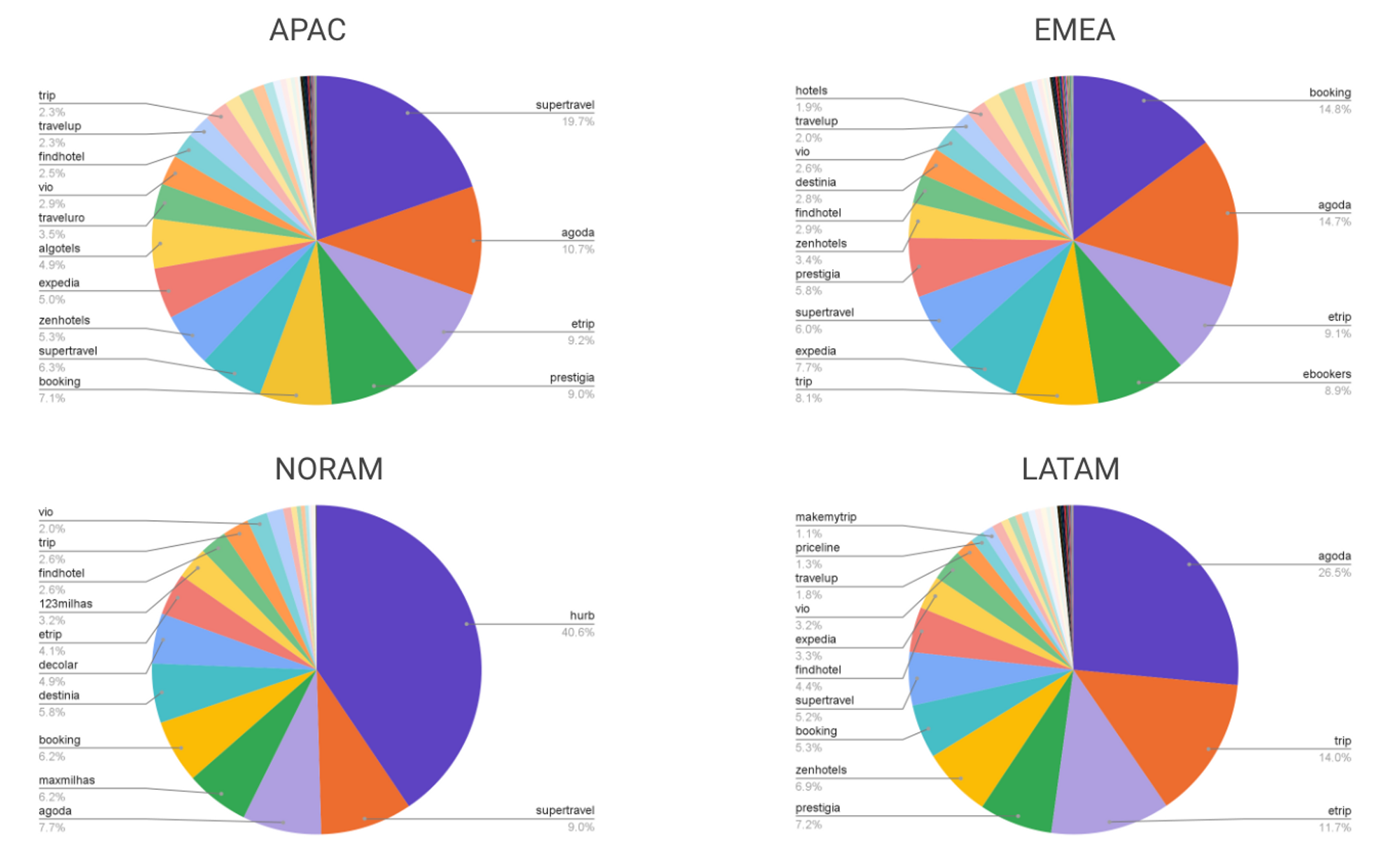

Who are you being undercut by?

Triptease’s global pricing database allows us to understand long terms parity trends. Below we are counting how many times each OTA had the best price in metasearch. Undercuts by major OTAs have a higher impact than undercuts from smaller 'random.coms'.

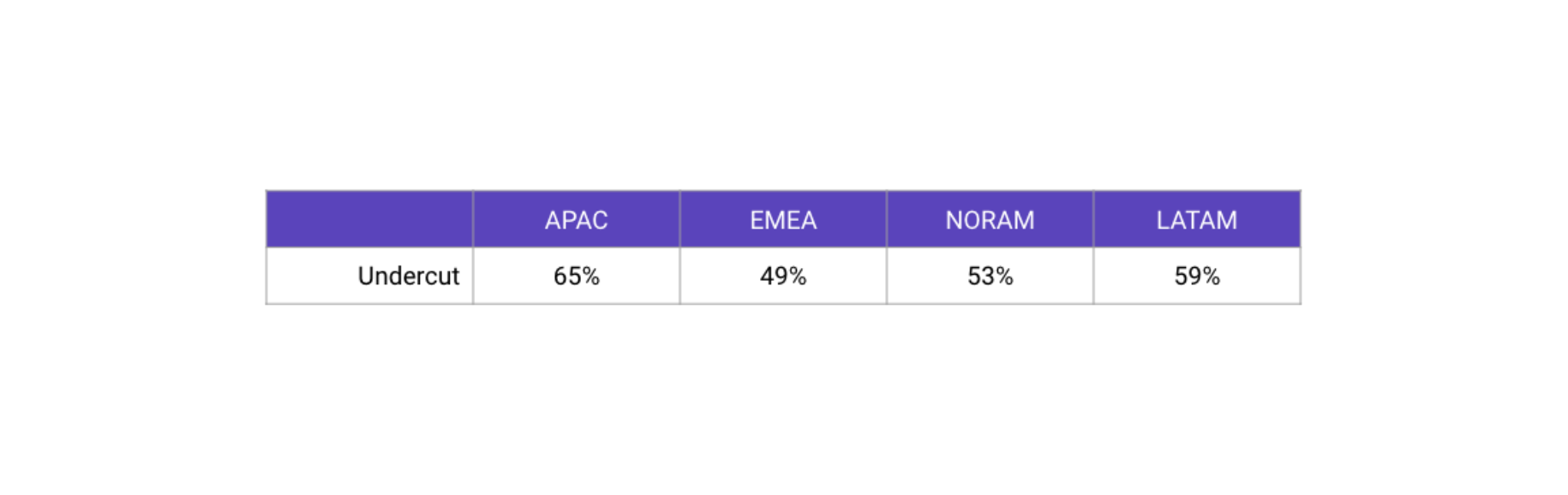

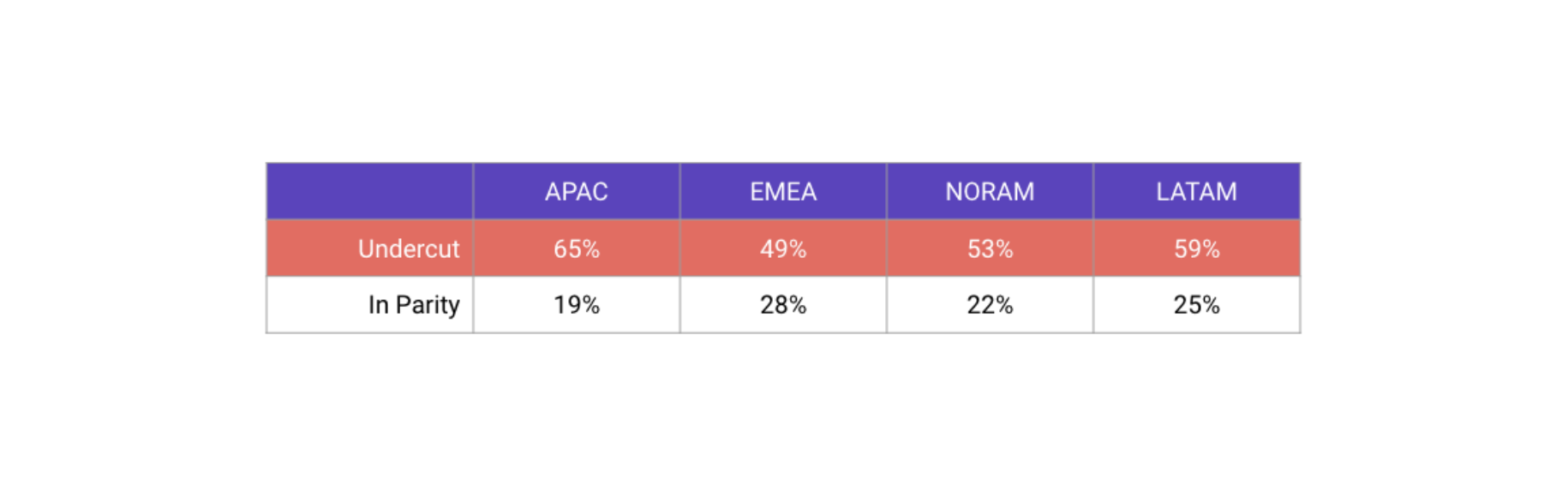

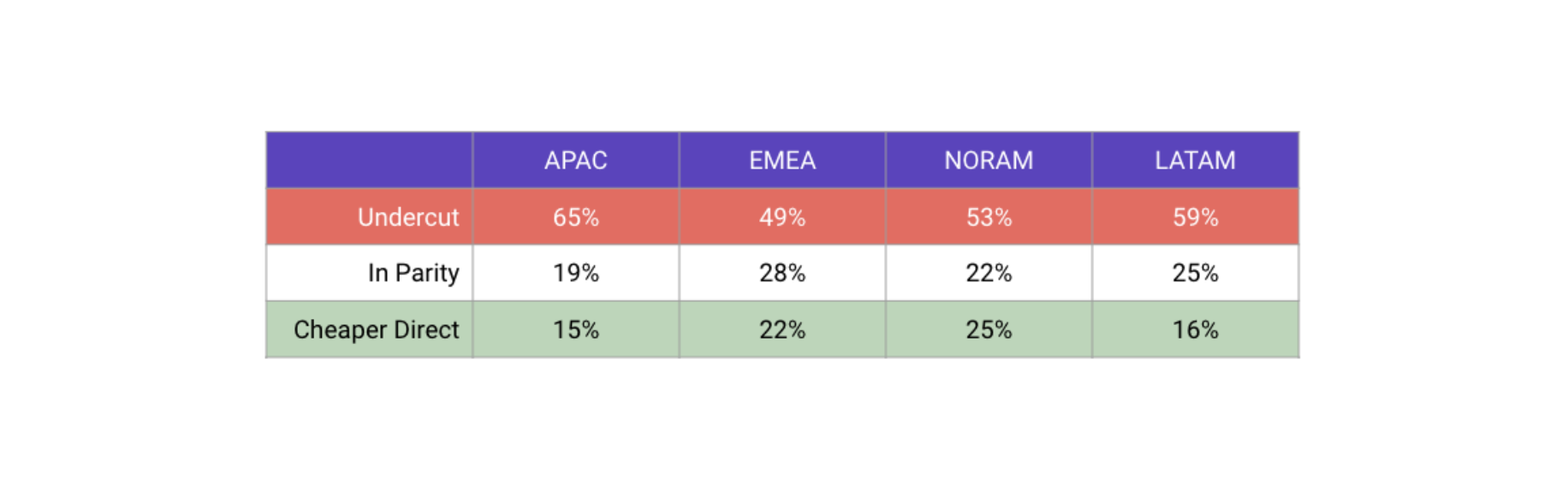

How often you are being undercut?

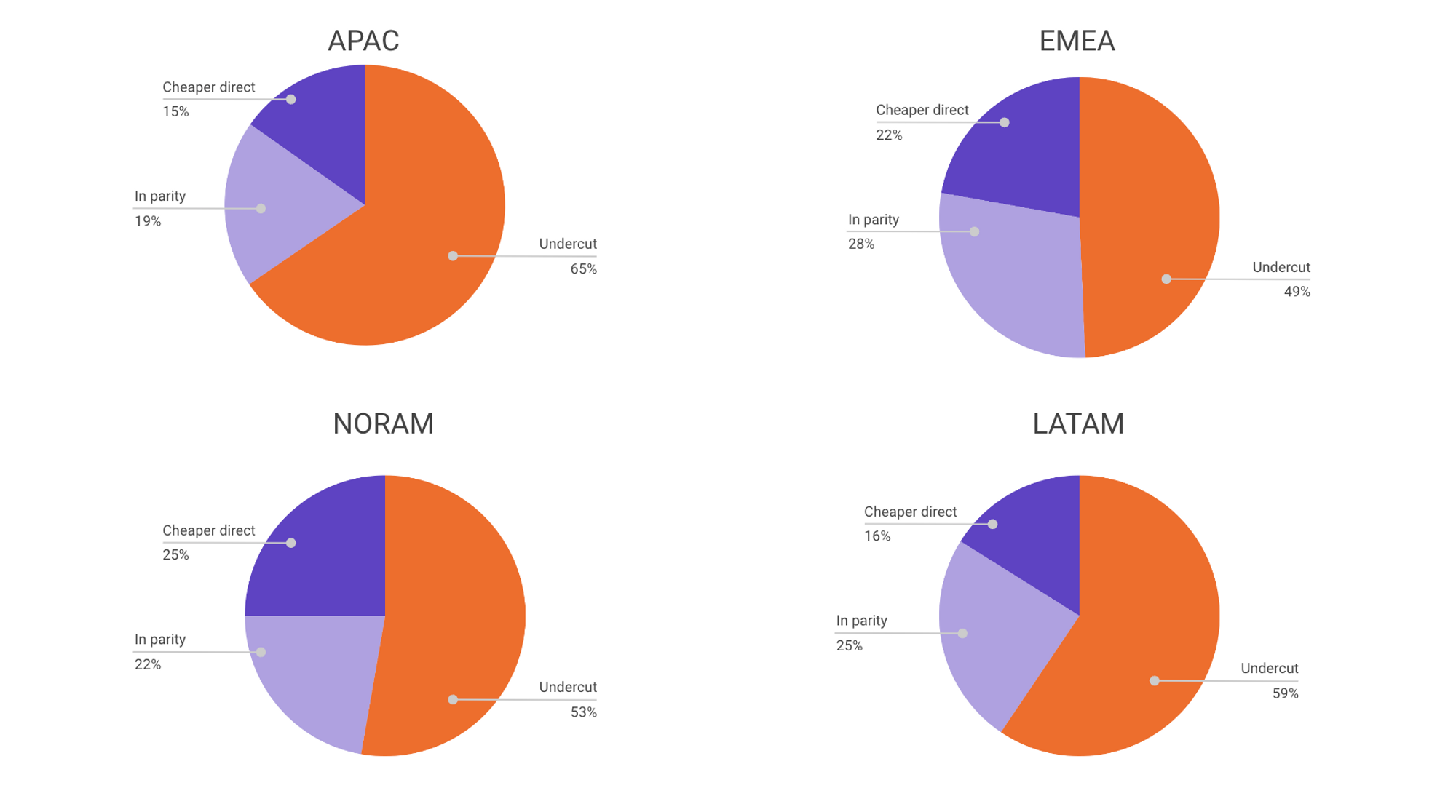

When segmented by region the data showed a similar story across Asia-Pacific, Europe, the Middle East and Africa, North-America and Latin-America. Across all regions the direct rate is being undercut over 50% of the time!

… while being in parity only about a quarter of the time…

… and cheaper direct, only 15-25% of the time.

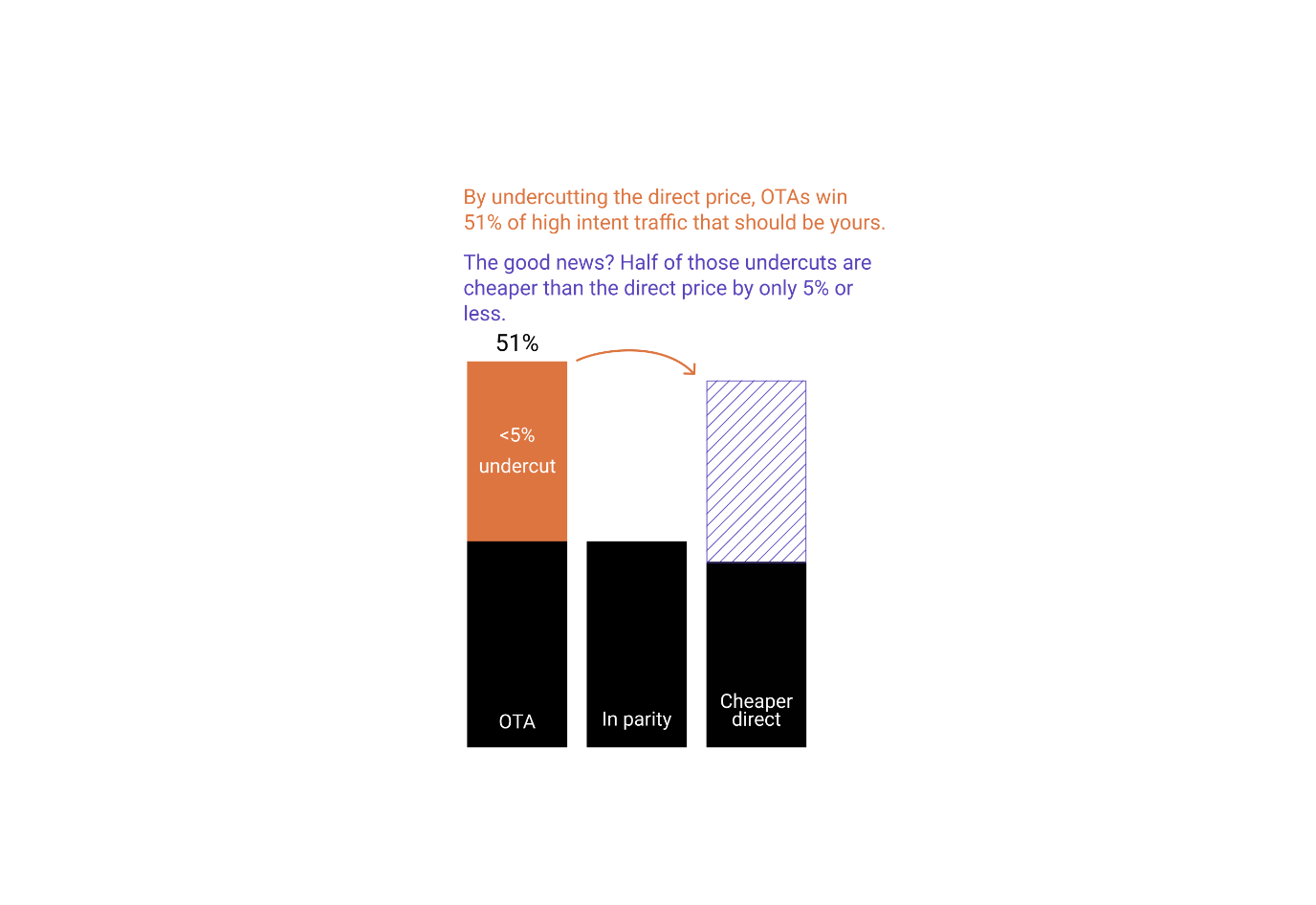

That means hoteliers miss out on over 50% of high intent traffic and high converting guests. The result? Margins continue to get smaller and smaller for hotels.

How much am I being undercut by?

It’s important to note that not all undercuts are uniform. When we talk about undercuts, we tend to bulk them all under one umbrella marked ‘unsolvable’ since most undercuts are too high for hotels to combat. Or you might have believed.

But what if some of those undercuts were cheaper and easier to solve than overs? There are probably some big price undercuts that you’d never be willing or able to compete with - but what about the prices that are only a matter of a few dollars? Would that then provide some light at the end of the tunnel for hoteliers?

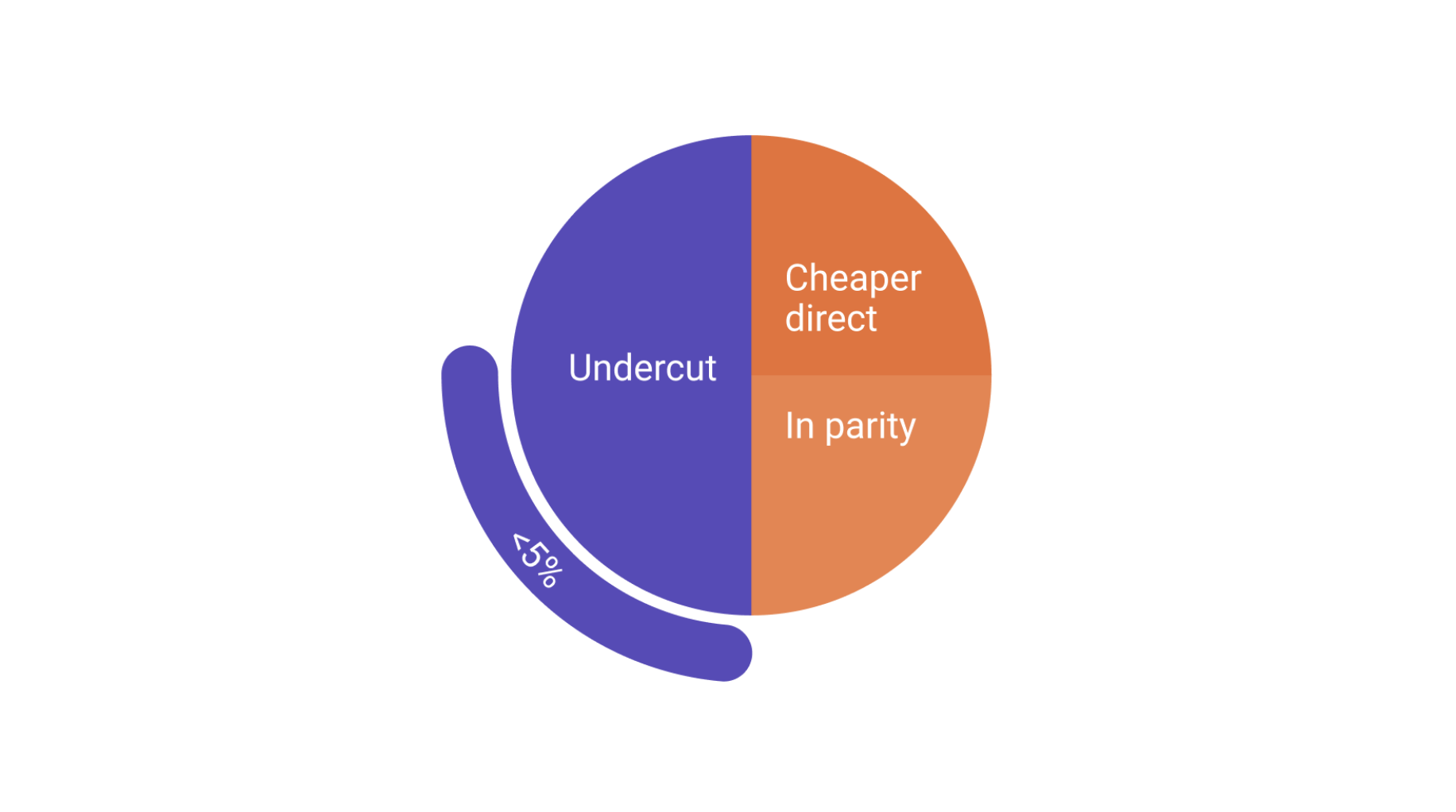

According to Triptease data, 25% of a hotel’s metasearch price issues are made up of undercuts less than 5%.

What does this mean for hoteliers?

Hotels should focus on winning back the ‘accessible’ portion of undercuts; the portion which are less than 5% yet make up approximately 50% of the total undercuts.

What can hotels do to combat these smaller undercuts?

As frustrating as it is, OTAs hold a powerful position over hotels. Triptease has previously helped to minimise the problem of price undercutting through exclusive smart parity bidding features:

- Parity Boost - increasing conversions by boosting your price when it’s the cheapest

- Parity Blackout - protecting your brand saving ad spend by removing your price when you’re significantly undercut.

While these features adjust bids to make the most of the hotel’s existing parity situation, they won't 'fix' a hotel's parity and ensure they win the booking. That’s why we are excited to announce Price Match on Metasearch. Triptease’s latest innovation is a game-changing feature for hotels tackling metasearch price undercuts.

So, what do we know so far?

We know that over 50% of undercuts from major OTAs are less than 5%. We also know that undercuts by major OTAs have a much higher impact on direct bookings than undercuts from smaller random.coms.

But what if hotels could remove the highest impact undercuts from metasearch before a guest ever sees them? What if hotels could discount the direct price for each individual meta customer, 'just in time' and by 'exactly enough' to make the direct price the best choice for that specific guest?

Triptease Price Match on Metasearch detects when a high impact OTA is undercutting you in the meta auction and dynamically adjusts the direct price in both the metasearch results and on the booing engine. That means hoteliers can ensure they have the most competitive price when it matters most and drastically increase their metasearch conversions.

How does Price Match on Metasearch work?

The discount range is pre-set by the hotelier and only applied for their chosen OTAs. That means hoteliers have full control over their metasearch pricing while ensuring they have the most competitive rate when it matters most.

Win back traffic and bookings with the Price Match on Metasearch.

1. Gain immediate incremental revenue.

2. Dynamic price adjustments that you control.

3. Instantly match undercut prices in the auction and booking engine.

Interested in learning more about how your hotel can drive more direct bookings from Metasearch Price Match? Contact us today.

.png?width=800&height=358&name=Meta-masterclass-web-banner%20(3).png)

Register now